In the ever-evolving landscape of small businesses, one crucial aspect that often goes unnoticed is the accurate maintenance of transaction records. While it may seem like an arduous task for small business owners already juggling numerous responsibilities, keeping precise records of financial transactions is paramount for their long-term success.

This article explores the reasons why accurate record-keeping is vital for small businesses and how it can contribute to their growth and sustainability.

5 essentials practices for business success

Compliance and Legal Obligations:

Small businesses, just like any other enterprise, must adhere to specific legal requirements and regulations. Precise record-keeping ensures compliance with taxation laws, accounting standards, and financial reporting obligations. By maintaining accurate transaction records, businesses can effectively fulfil their legal responsibilities, avoid penalties, audits, and any unnecessary legal entanglements.

Financial Decision Making:

Accurate records provide small businesses with valuable financial insights necessary for informed decision-making. By tracking income, expenses, and cash flow patterns, businesses can analyse their financial health, identify profitable ventures, and make data-driven decisions. These records facilitate budgeting, forecasting, and the evaluation of business performance, leading to improved operational efficiency and strategic planning.

Tax Preparation and Audit Defence:

Preparing tax returns can be a daunting task for small businesses. With accurate transaction records readily available, the process becomes more efficient, saving time, and reducing stress during tax season. Moreover, in the event of an audit, accurate records act as an irrefutable defence. They provide evidence to support claims, validate deductions, and verify income, ensuring businesses are not unfairly penalized.

Financial Analysis and Investors’ Trust:

Accurate transaction records instil confidence in investors, lenders, and stakeholders. When seeking funding or partnerships, potential investors evaluate a business’s financial stability and growth potential. Well-maintained records serve as a reliable source for assessing profitability, financial ratios, and future prospects. Investors are more likely to trust businesses that demonstrate meticulous record-keeping, enhancing their credibility and increasing access to capital.

Risk Management and Fraud Prevention:

Small businesses are vulnerable to fraud and financial irregularities. By maintaining accurate transaction records, business owners can detect and prevent fraudulent activities within their organization. Detailed records act as a deterrent, making it easier to identify discrepancies, track suspicious transactions, and protect against internal and external fraud. They also provide a historical record that can be used for internal investigations and legal purposes, if required.

Small businesses face numerous challenges, and accurate record-keeping may seem like a low priority. However, the significance of maintaining precise transaction records cannot be understated. From legal compliance to informed decision-making, accurate records are the backbone of a successful and sustainable business.

Small business owners should embrace robust record-keeping practices, leveraging technology and professional assistance when necessary. By doing so, they can unlock valuable insights, mitigate risks, foster trust with stakeholders, and pave the way for growth in an increasingly competitive business landscape.

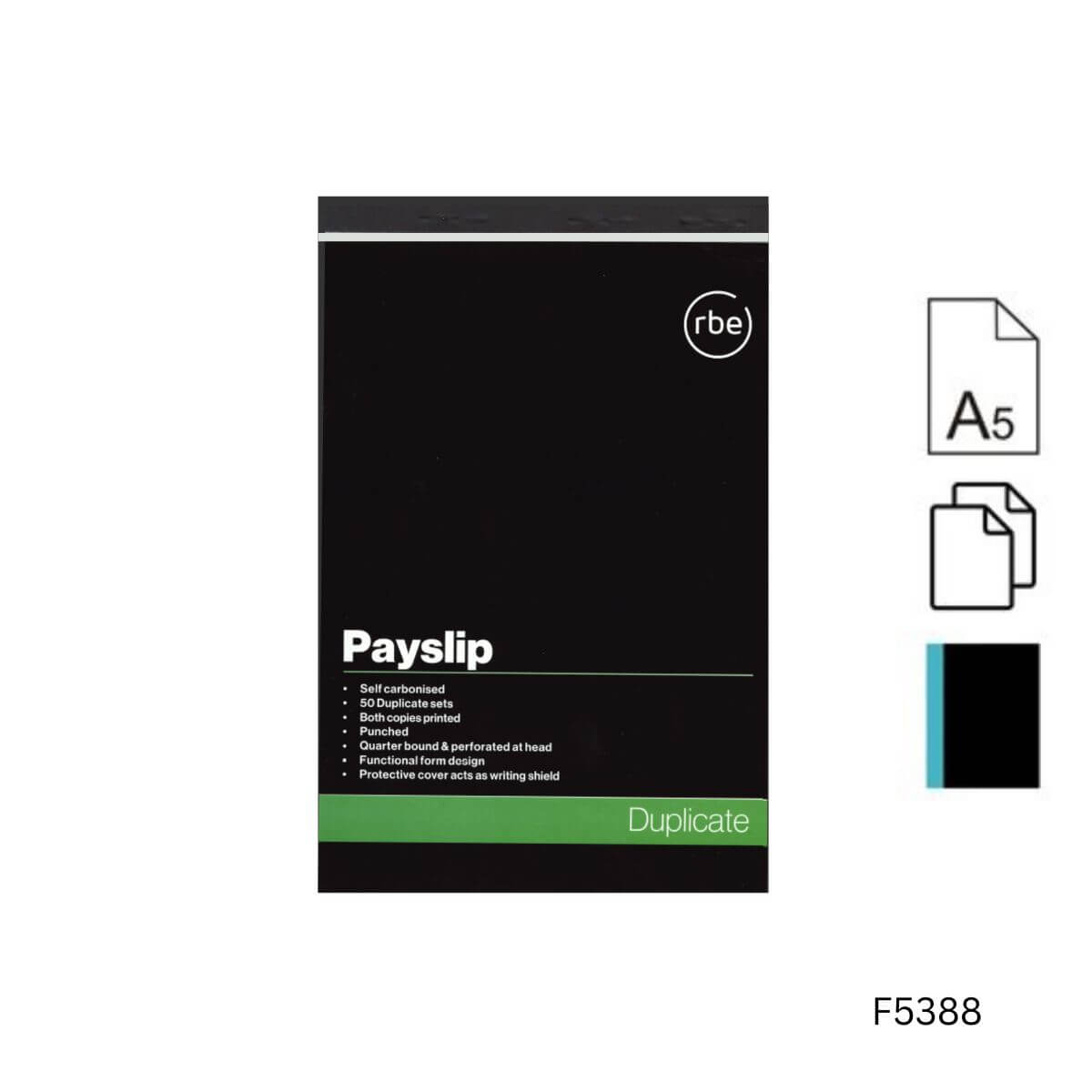

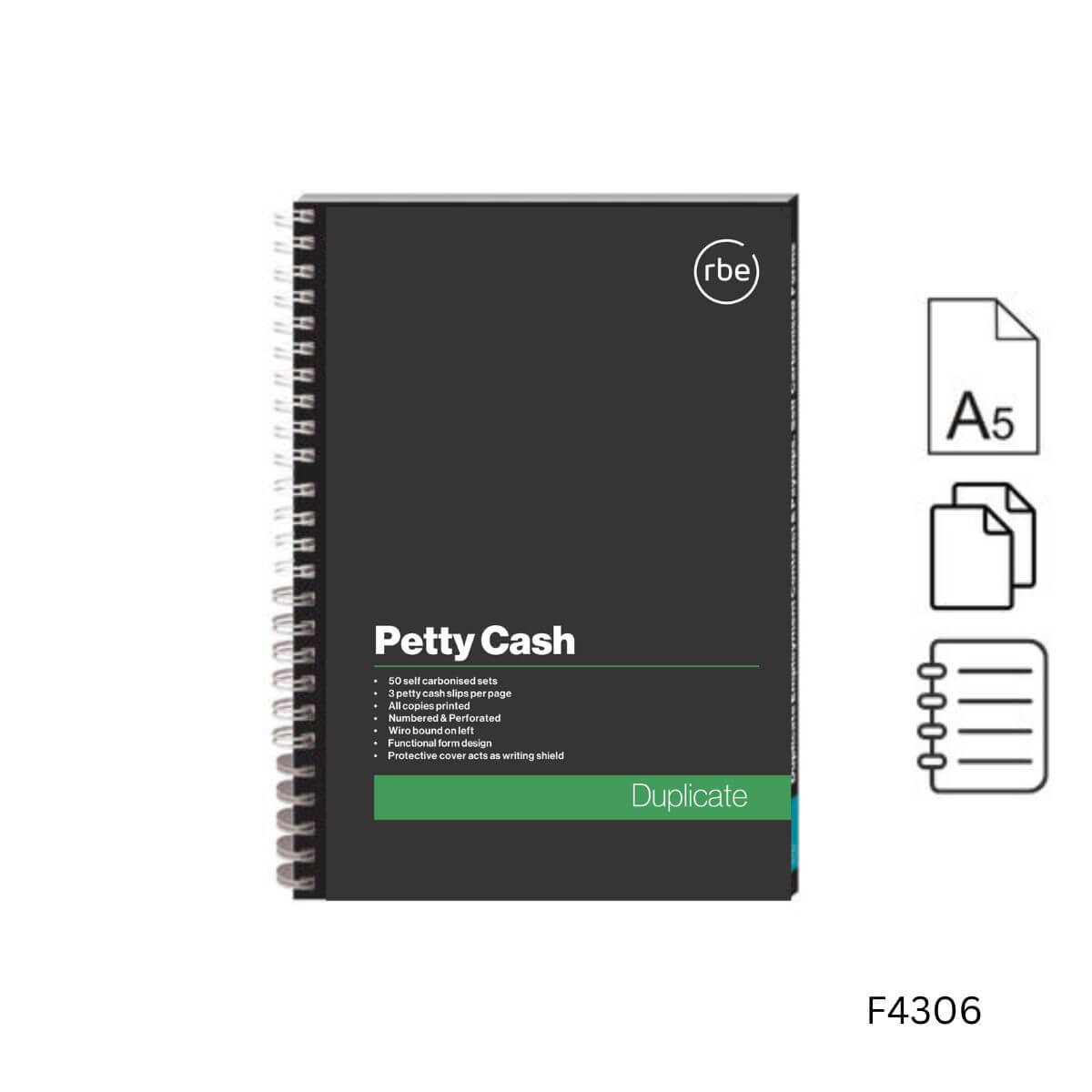

In conclusion, the RBE Range of Business Books provides small businesses with a valuable tools for maintaining accurate records of transactions. By doing so, businesses can ensure compliance, manage finances effectively, promote transparency, and support growth. Accurate record-keeping is a fundamental practice that empowers small businesses to thrive in a competitive and dynamic business environment.

RBE

RBE

Share this entry